2026 Paid Family and Medical Leave Updates: What Employers Need to Know

15 min read

·

December 10, 2025

As 2026 approaches, several states are launching new Paid Family and Medical Leave programs, while others have announced significant updates to existing plans. We’ll refer to these programs collectively as “Paid Leave.” Staying on top of these changes is essential for employers to maintain compliance, adjust payroll deductions, and keep employees informed.

We’ve outlined the key updates below and shared some tips to help your organization get ready. It’s a lot to cover, so buckle up!

What Can Change in Paid Family Leave Programs?

Paid Leave is often tied to wage growth and economic conditions, which means adjustments are made annually to reflect these changes. Below are the main elements that may change year-to-year:

Benefit Amount: States may increase the maximum weekly benefit to reflect rising wages or cost-of-living adjustments.

Benefit Length: The number of weeks an employee can take for Paid Leave may be extended.

Other Benefit Terms: Other terms may change as well, such as how Paid Leave is coordinated with accrued PTO and sick leave.

Contribution Rate: The percentage of an employee’s wages contributed to the Paid Leave fund may be adjusted, either increasing or decreasing based on program funding requirements.

Key Updates in 2026

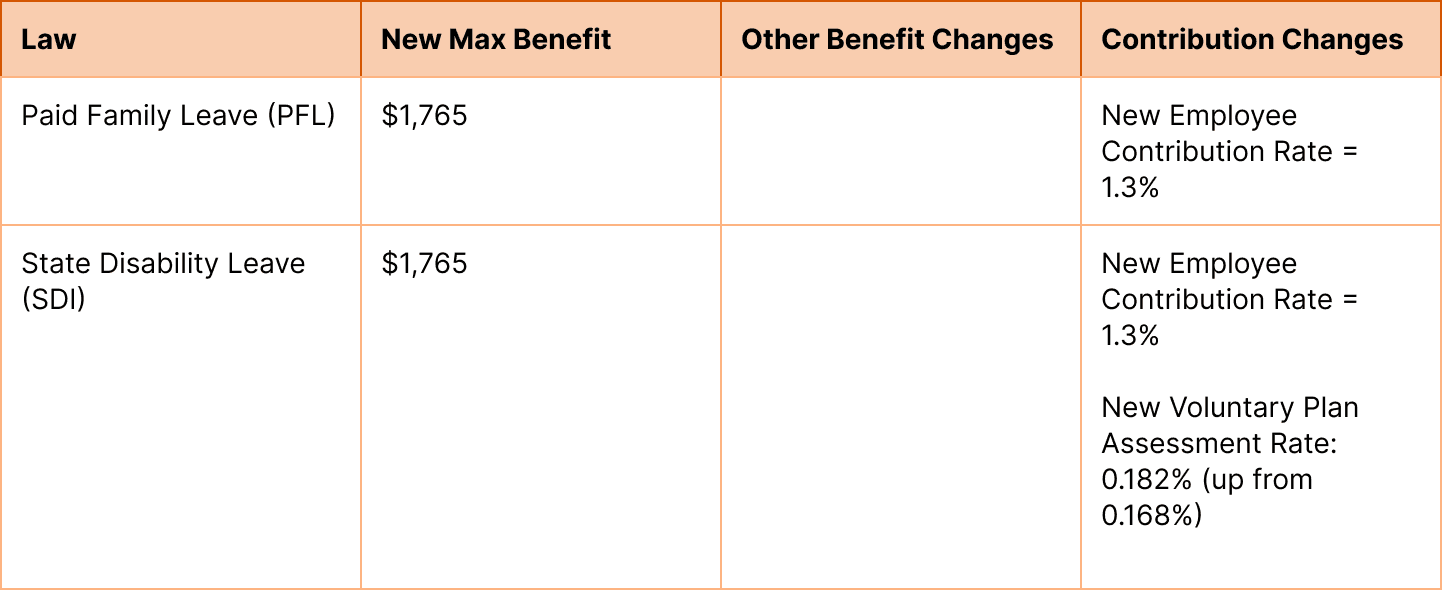

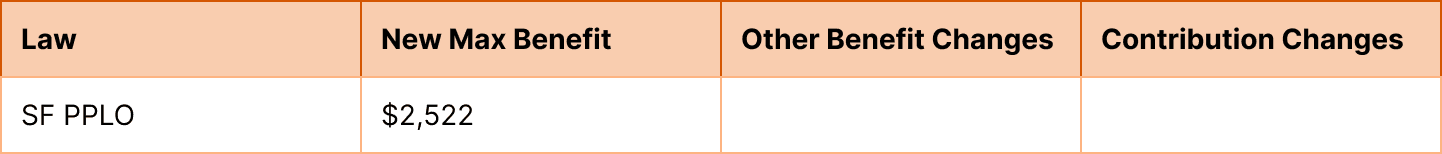

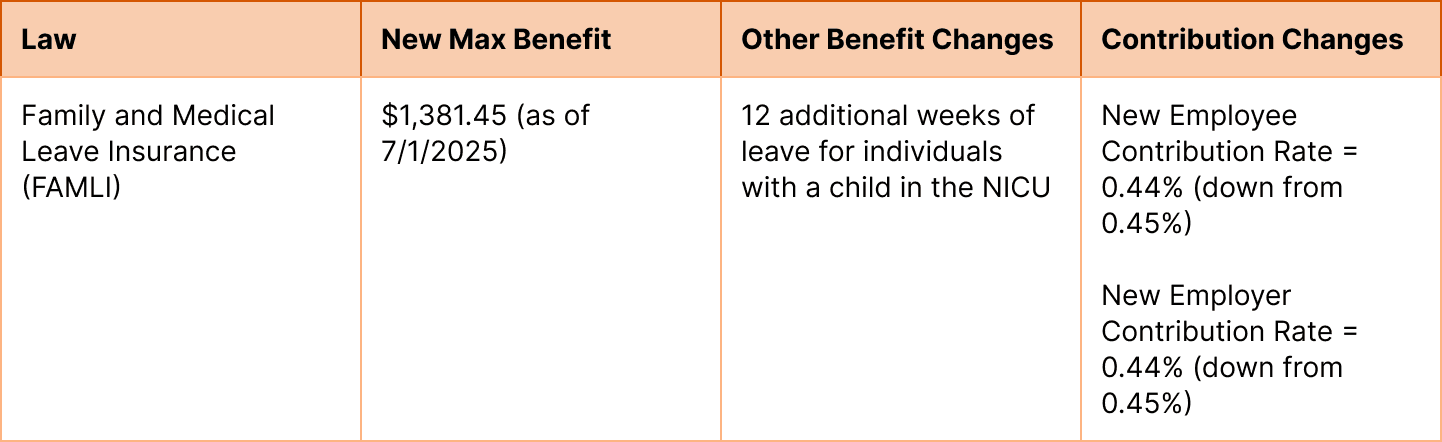

Below, we’ve outlined the anticipated updates for Paid Leave programs across states. This chart has been updated as of December 1, 2025.

California

San Francisco

Colorado

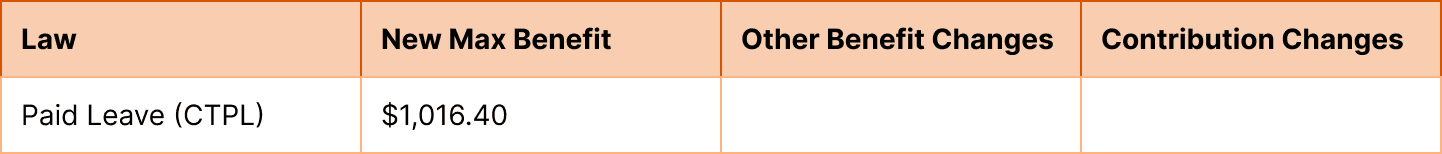

Connecticut

Delaware (NEW)

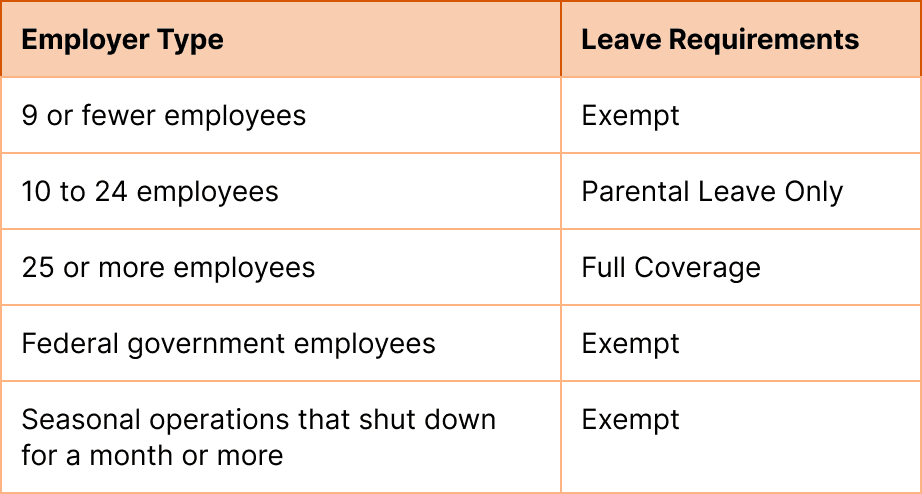

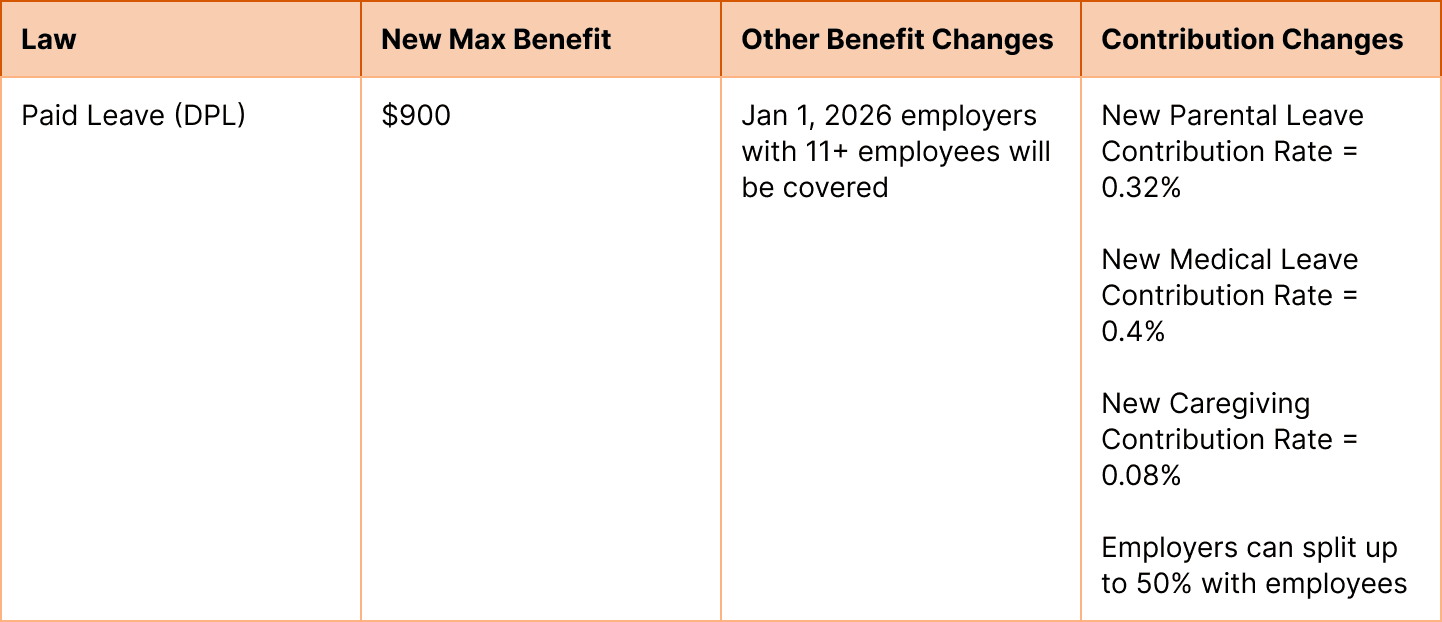

The new Delaware Paid Family Leave program begins on January 1, 2026.

Participating in Delaware Paid Leave is mandatory for most businesses with 10 or more employees working in Delaware.

More information can be found here.

D.C.

Employers have until February 1, 2026 to post the updated notice and provide a copy to all covered employees.

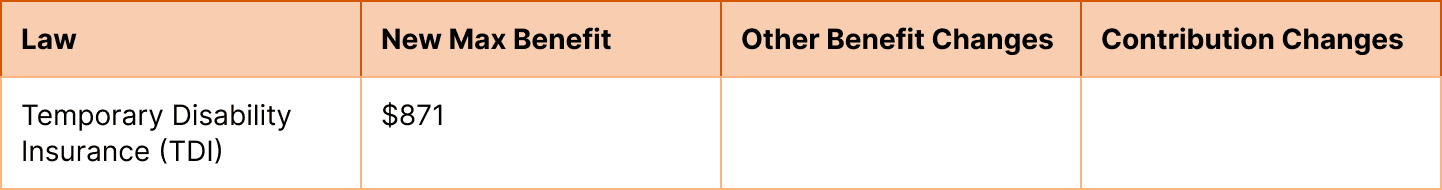

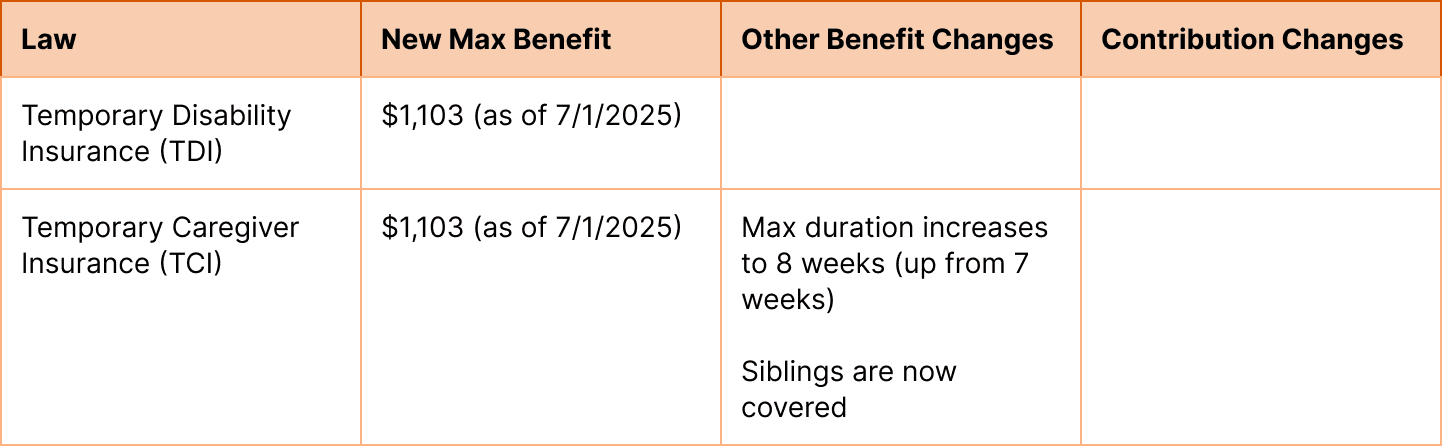

Hawaii

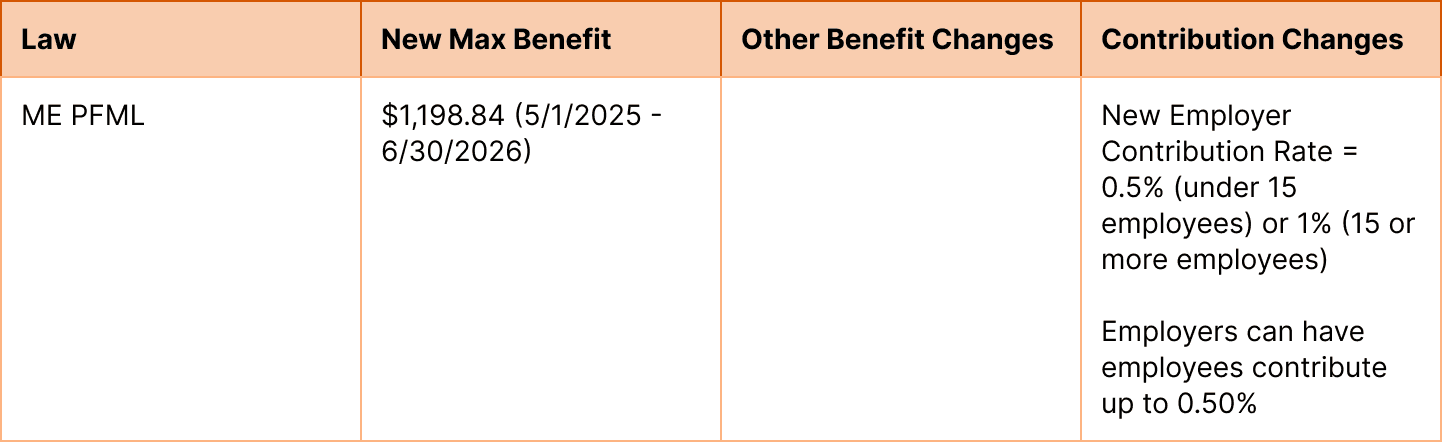

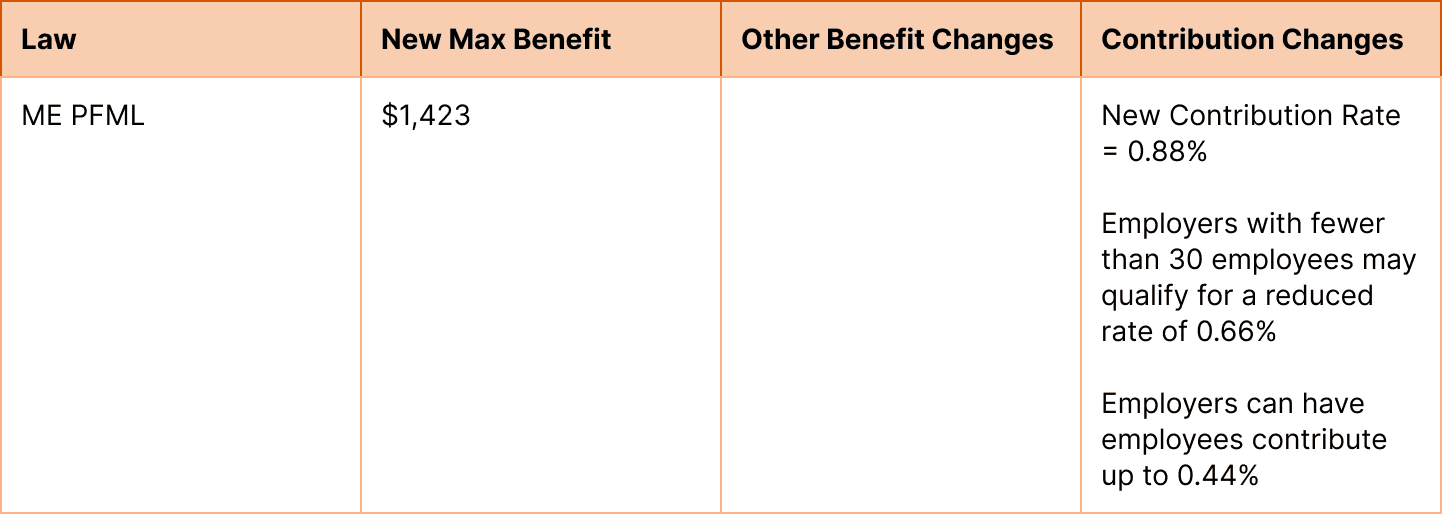

Maine (NEW)

The new Maine Paid Family and Medical Leave program begins paying benefits on May 1, 2026.

More information can be found here.

Maryland (DELAYED - 2028)

The Maryland Family and Medical Leave Insurance (FAMLI) program has been delayed with benefits beginning on January 3, 2025.

Contributions begin January 1, 2027 and the initial contribution rate is expected to be set by May 1, 2026.

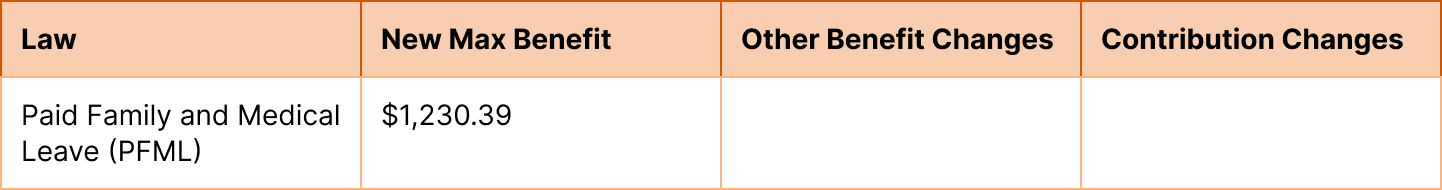

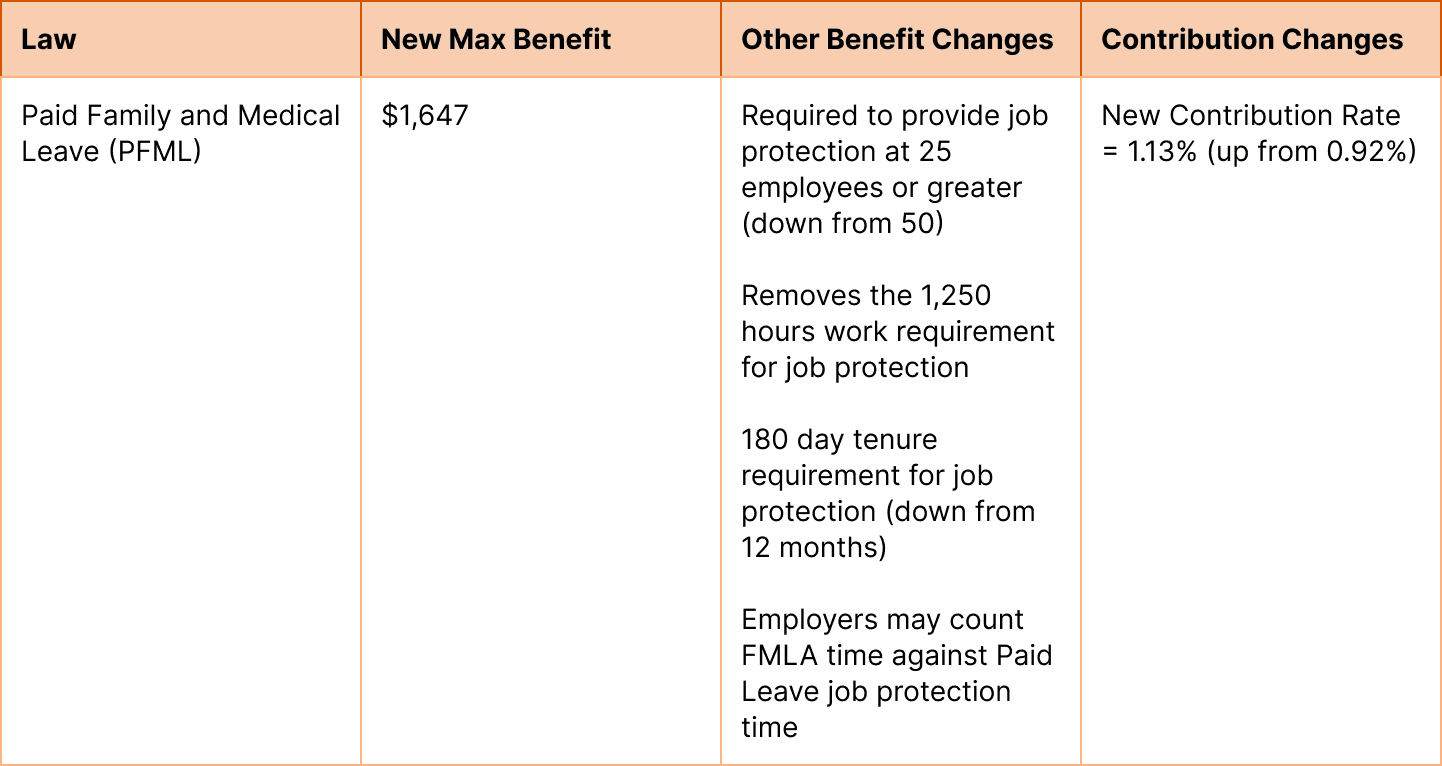

Massachusetts

Minnesota (NEW)

The new Minnesota Paid Leave program begins on January 1, 2026.

Note: Employees who had a child in 2025 may be eligible to take bonding leave in 2026, as long as it is within 12 months of the birth or placement.

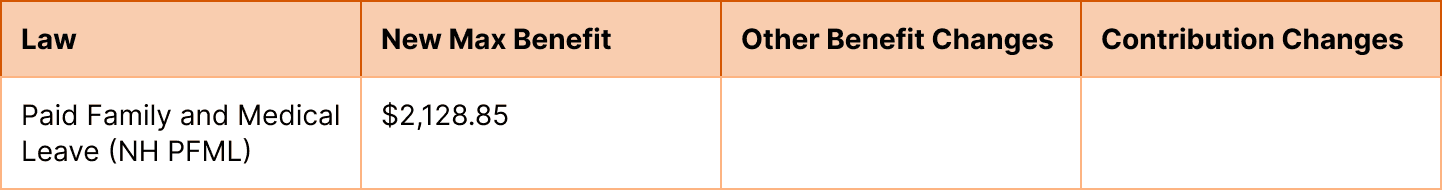

New Hampshire

This is a voluntary paid family and medical leave program that you must opt into.

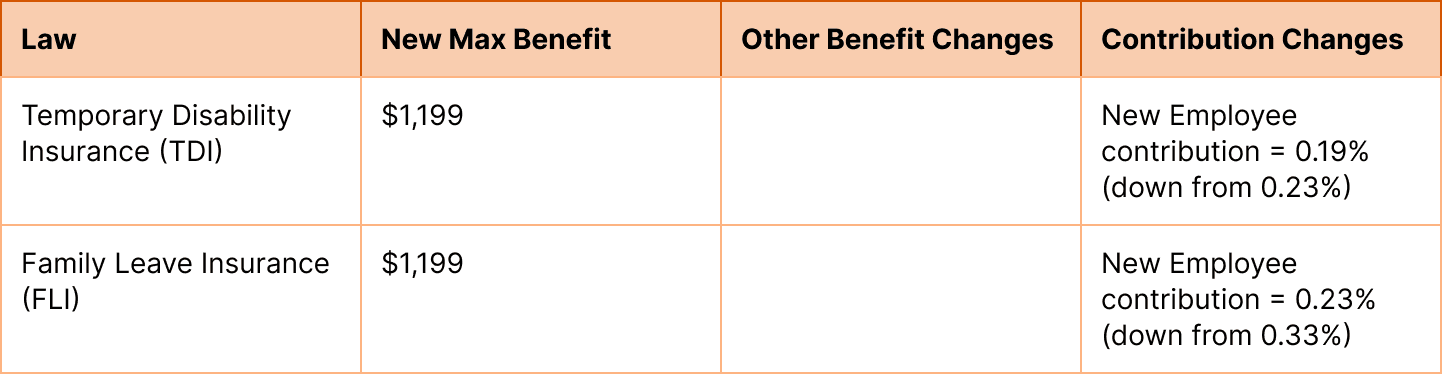

New Jersey

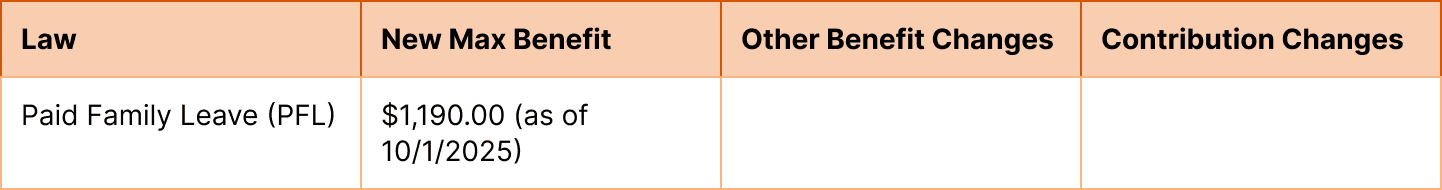

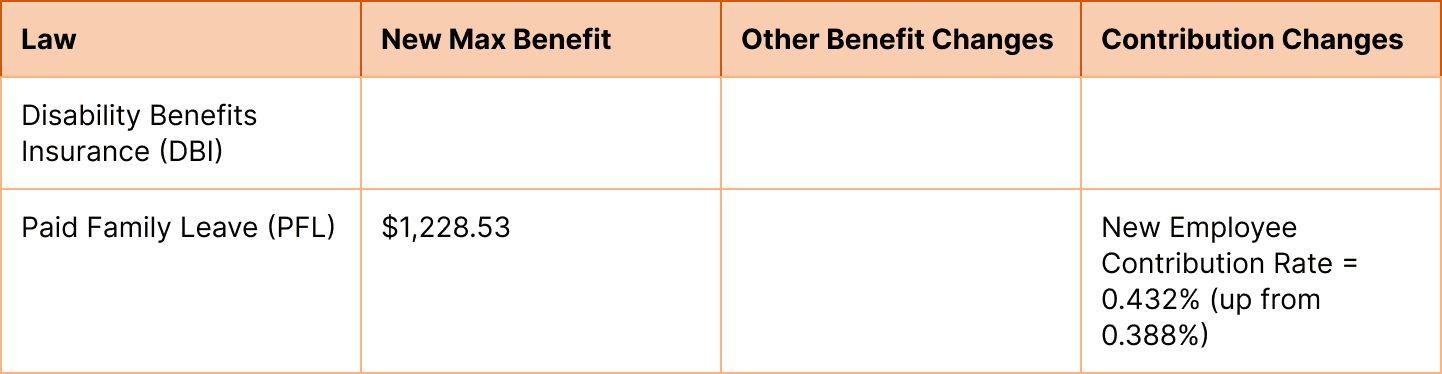

New York

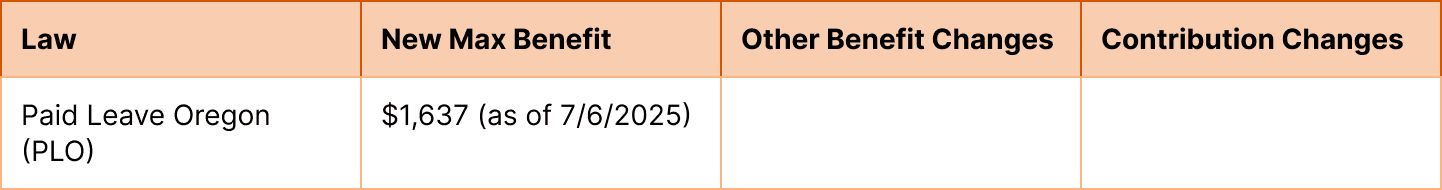

Oregon

Rhode Island

Washington

How to Prepare for 2026 Changes

Monitor State-Specific Announcements: Stay informed about updates in the states where your company operates, as requirements can vary widely - including annual notice obligations.

Update Payroll Systems: Update payroll configurations to reflect new contribution rates, maximum employee contributions, and taxable wage caps. These adjustments must be in place before the first paycheck of 2026, as retroactive deductions are generally not allowed.

Communicate with Employees: Notify employees of any changes to their payroll deductions, especially if contribution rates or caps are increasing. Proactive, clear communication builds trust and avoids confusion.

Review Leave Policies: Update your internal leave policies to align with new benefit amounts, lengths, and eligibility requirements, as well as any language you’ve included on the state programs.

Consider Investing in a Leave Management Tool: Paid Leave programs are constantly evolving, and the risk of non-compliance is real. A leave management tool can serve as your single source of truth, saving your team countless hours and reducing stress while ensuring you stay compliant.

About Aidora

Want to receive more updates like these? Follow us on LinkedIn or subscribe to our newsletter.